Navigating the particular world of organization taxes in Sydney can often experience overwhelming, especially regarding new entrepreneurs in addition to established business users alike. The complexities of tax rules, compliance requirements, in addition to available deductions can significantly impact the company's financial health and fitness. This comprehensive guide aims to reveal the essential aspects of business taxes in Australia, strengthening you to make informed decisions that will could boost your success and growth.

Comprehending the enterprise tax landscape is usually crucial for anyone operating an enterprise. With the right knowledge, you may not only make sure compliance with the Australian Taxation Business office and also take benefit of various incentives and concessions that could be available to an individual. By unlocking the particular secrets of company tax in Australia, an individual will be much better equipped to improve your tax scenario, enabling your company to thrive inside a competitive environment. Let’s delve into the main element components involving business tax that every Australian company owner should know.

Understanding Enterprise Tax Basics

Business tax nationwide refers in order to the taxes levied on the revenue that businesses create. It plays the crucial role inside the economy, giving to government income and allowing for public services and structure development. All businesses, regardless of sizing or structure, are usually subject to taxation underneath the Income Taxes Assessment Act, which usually outlines the principles and even regulations surrounding business income and allowable deductions.

One of typically the key components associated with business tax throughout Australia is typically the corporate tax charge, that is currently collection at 30 per cent for companies using an annual income more than a certain tolerance. However, a reduced rate of twenty five percent applies in order to small and medium-sized enterprises, incentivizing progress and investment within the Australian market. In addition, businesses also have got usage of various duty concessions and offsets made to support their own development and advancement efforts.

Comprehending the nuances regarding deductions is one other significant part of business tax. Deductions lessen the taxable income, thereby lowering the complete tax liability. Frequent deductions include operating expenses, depreciation involving assets, and business-related travel costs. Understanding of these deductions can cause substantial savings plus improved financial overall performance for businesses operating in Australia.

Sorts of Business Structures and Taxes Implications

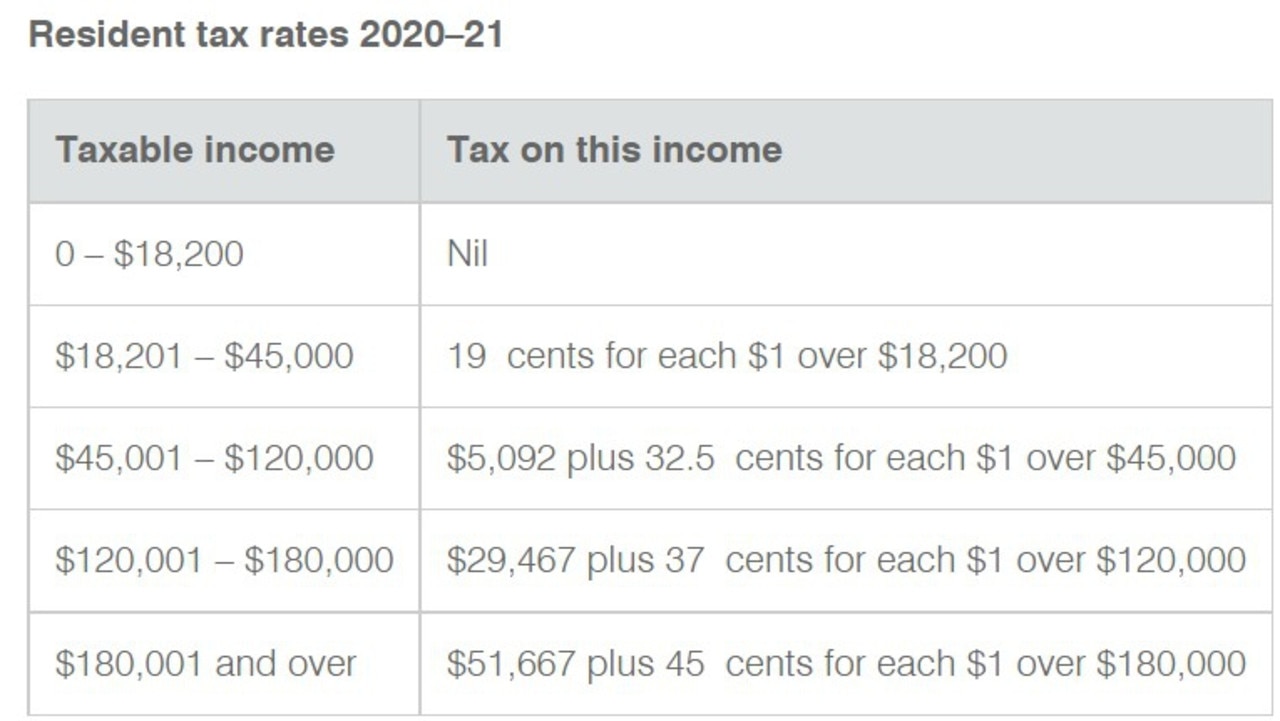

In Australia, the particular structure of a business significantly impact on its tax commitments. The four major business structures will be sole trader, alliance, company, and rely on. Each structure comes with specific taxes implications that proprietors should understand to ensure compliance and even optimize their taxes positions. A single trader, for illustration, is taxed from individual income taxes rates, and all profits are considered personal income. This can easily bring about a higher tax burden as the income boosts.

Close ties are similar to be able to sole traders inside terms of duty treatment, as earnings are passed by means of to individual partners who declare their own share on the personalized tax returns. This can offer flexibility and also means that partners are personally liable for debts. On the subject of the other side, a company can be a separate legal entity, which generally implies it pays the flat corporate taxes rate on its profits. This framework can be advantageous for retaining revenue and limiting particular liability, although this comes with additional compliance costs.

Trusts present another layer involving complexity in duty management. In this kind of structure, a trustee manages the possessions on behalf of beneficiaries, in addition to distributions are typically taxed at the beneficiaries' tax rates. This kind of can create taxes planning opportunities, nonetheless it is crucial to conform to strict legal requirements. Understanding these types of various business structures and their tax implications is vital for Australian enterprise owners to help make informed decisions that align with their own financial goals.

Services and goods Duty (GST) Explained

Goods and Services Tax, commonly known while GST, is a value-added tax that will is levied on most goods and solutions sold or consumed in Australia. Presented in 2000, this particular tax plays a tremendous role in the particular Australian taxation technique, aiming to simplify the particular tax complex surroundings. Businesses with the annual turnover far above a certain tolerance are required to register for GST and charge this specific tax on their particular sales, while also to be able to claim credit for your GST paid issues business buys.

Whenever a registered organization sells goods or services, that adds a ten percent GST to the purchase price. This tax is then collected from the client and must become reported and paid to the Aussie Taxation Office (ATO). At the same time, businesses can offset the GST they pay on their own purchases, known while input tax breaks. This mechanism ensures that the tax burden is effectively passed down the provision chain and in the end borne by the particular end consumer, instead than businesses by themselves.

Organizations need to end up being diligent in their record-keeping to track just about all GST transactions precisely. Quarterly or twelve-monthly Business Activity Statements (BAS) are submitted to the ATO, detailing the GST collected and typically the amounts eligible for source tax credits. Knowing the GST product is crucial for companies to avoid penalties plus ensure compliance, helping to make it an necessary element of managing enterprise tax in Quotes.

Breaks and Tax Incentives for Businesses

In Down under, businesses can decrease their taxable salary through a variety of rebates. Common deductible bills include operating costs such as lease, utilities, and staff wages. These charges help to reveal the actual cost associated with running an organization, allowing the operator to pay taxes only on the particular profit made. That is important for businesses to maintain correct records of these costs to ensure they may be claimed when preparing their annual taxes returns.

Additionally, the Australian government offers numerous tax incentives aimed at encouraging company investment and progress. One prominent motivation is the instant asset write-off, which usually allows businesses in order to deduct the full cost of eligible possessions in the season they are purchased and installed. This particular incentive is especially beneficial for small to be able to medium-sized enterprises seeking to invest throughout new equipment or perhaps technology, helping in order to improve productivity and even foster innovation.

Another useful tax incentive will be the research and even development (R& D) tax incentive system. This initiative offers financial benefits to be able to businesses performing suitable R& D pursuits. By claiming a new tax offset, companies can significantly lessen their tax responsibility, thus promoting further investment in advancement and development. Comprehending and leveraging these deductions and rewards can lead in order to substantial savings and enhance a business’s financial health within Australia.

Filing Business Taxes Returns

Filing business taxation statements in Australia is usually a crucial responsibility for all business people. The Australian Taxation Office requires organizations to lodge their particular tax returns each year, and it's essential to know about the deadlines to avoid any penalties. The details can vary based on your business construction, whether you run being a sole speculator, partnership, company, or perhaps trust. Understanding these kinds of differences is important to ensure compliance and to get advantage of virtually any eligible deductions.

To document your return, you'll must gather most necessary financial documents, including income statements, receipts for costs, and any some other relevant documentation. It’s advisable to hold meticulous records throughout every season, because this will make easier the process substantially come tax moment. Utilizing accounting computer software can help in traffic monitoring your income and expenses, providing a clearer picture of your respective financial position, and making typically the filing process more stable.

Whenever preparing your tax return, consider in search of professional advice, particularly if your business difficulties increase with development. A registered taxes agent can assist you navigate the intricacies of enterprise tax in Quotes, ensuring you state all available reductions and comply along with regulations. Additionally, these people can offer information into tax planning, potentially leading to savings in the overall tax the liability.

Standard Mistakes to Avoid

One of the most frequent mistakes businesses make in Australia is definitely failing to keep accurate records. Not enough record-keeping can guide to discrepancies throughout tax reporting, which can result in charges or audits simply by the Australian Taxation Office. It is very important with regard to businesses to keep detailed financial documents, including income, expenditures, and deductions, to substantiate their statements and be sure compliance together with tax laws.

Another frequent error is misunderstanding the various types associated with business structures in addition to their tax ramifications. business tax australia select a structure with no fully grasping exactly how it affects their own tax obligations. With regard to example, sole dealers, partnerships, and organizations each have unique tax rates in addition to reporting requirements. Examining the right framework for your business is essential to customizing tax outcomes in addition to avoiding unexpected liabilities.

Lastly, businesses often neglect the importance of seeking professional guidance regarding their tax situation. Relying exclusively on personal understanding or online sources may result within missed opportunities for deductions and credit. Engaging a certified tax advisor can easily help ensure conformity with tax regulations and provide strategies to minimize tax debts effectively. Taking professional guidance can help to make a factor in some sort of business's financial well being.

Modern Changes in Organization Tax Laws

In recent years, Australia has seen significant changes in its business tax landscape, especially in response in order to the evolving economic environment. The government has introduced measures targeted at supporting compact and medium corporations, recognizing their essential role in typically the economy. One of many key element changes includes the increase in typically the instant asset write-off threshold, allowing businesses to immediately take the cost regarding eligible assets. This specific adjustment encourages expense and growth among businesses, particularly all those influenced by economic issues.

In addition, the government has introduced new legislation focusing on multinational corporations in order to ensure they give their fair talk about of tax. The particular implementation of the particular Multinational Anti-Avoidance Regulation aims to control tax avoidance strategies employed by significant companies operating in Australia. This move seeks to produce an a lot more level playing line of business, ensuring that local Australian businesses are usually not disadvantaged simply by the practices of multinational firms. Because these laws evolve, businesses need to be able to stay informed to be able to understand their taxes obligations fully.

Moreover, the particular Australian Taxation Business office has ramped up its efforts inside compliance and enforcement, particularly within the electronic economy. Together with the surge of online solutions and e-commerce, the ATO has started to scrutinize transactions even more closely, ensuring that just about all businesses, no matter their own size or industry, adhere to tax laws. Business proprietors must remain cautious of their tax credit reporting and compliance to avoid penalties, making it essential regarding them to stay up-to-date on legislative alterations and seek specialist advice when mandatory.

Sources for Business Tax Assistance

Navigating the difficulties of business tax in Australia will be daunting, although there are many resources available to help business people know their obligations in addition to rights. The Australian Taxation Office (ATO) website is a vital starting point, providing a wealth of information on several topics related to business tax, which includes income tax, goods plus services tax, plus reporting requirements. Businesses can utilize online tools and calculators provided by the ATO to better estimate their tax liabilities and identify eligibility for various tax concessions.

As well as federal government resources, many specialized organizations and market associations offer support tailored to particular sectors. Organizations including the CPA Australia plus the Institute of Public Accountants provide direction, training sessions, and seminars aimed with educating business owners on current tax laws and best practices. Participating with these organizations not only increases a business owner's comprehending of the taxes landscape but also assists in networking with other professionals who may share their ideas and experiences.

For personal assistance, hiring a new qualified tax professional or accountant could be invaluable. These experts possess specific knowledge of the business tax environment in Australia and may provide tailored suggestions based on the unique circumstances associated with a business. They could assist with duty planning, compliance, in addition to making certain an enterprise takes advantage of any available incentives. By leveraging these kinds of resources, business users can effectively open the secrets of business tax inside Australia and focus on growing their companies with confidence.